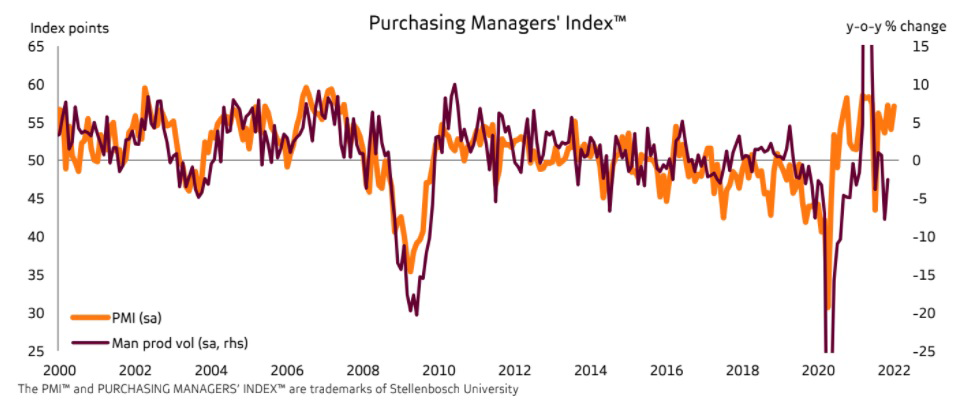

The seasonally adjusted Absa Purchasing Managers’ Index (PMI) recovered from December’s loss of momentum and rose to 57.1 index points in January 2022, following a dip to 54.1 in December 2021. The current level is in line with

November’s reading, but above the average recorded in the fourth quarter of 2021 and reflects a strong start to the year for the manufacturing sector.

The improvement in the headline Purchasing Managers’ Index (PMI) was to a large extent driven by a rebound in the business activity index, up from a low 48.7 points in December to 56.6 in January. The series is seasonally adjusted, so it should not merely be a ramp-up in production after a Christmas break that boosted output. Indeed, an improvement in the (also seasonally adjusted) new sales orders index suggests that demand looked better. In particular, respondents noted a rise in export sales, which could have boosted output. Further supporting the rise in the headline index was another increase in the inventories index. The employment index, albeit still below the neutral 50-point mark at 49.2 points, was less of a drag on the headline reading than the month before.

Generally, the Purchasing Managers’ Index (PMI) and most of the subcomponents rose to November’s levels following a decline in December. The forward-looking index paints an even more optimistic picture. The index tracking expected business conditions in six months’ time rose to an almost four-year high of 71.3 points – this is more than ten points above last year’s average reading. Especially amid a likely more challenging global environment of slower real GDP growth and higher interest rates, it is difficult to pinpoint a specific reason that drove the stark improvement in January. Perhaps the rapid downtick in South African COVID cases without the necessity of strict restrictions on activity eased some fears that future COVID waves would directly restrict output growth. With Omicron cases also peaking, or already having peaked, in many of South Africa’s trading partners, it could also be expected that export growth improves going forward as demand from the affected services sectors normalises. If sustained, the slight easing of supply chain disruptions in recent months will also be positive for the sector. Another boost to sentiment may come from a bounce back in the local tourism industry following the unwinding of travel bans, aiding manufacturing subsectors with linkages to the hospitality industry.

After reaching an almost six-year high last month, the purchasing price index nudged only slightly lower and remained high at 88.9 points. The decline in the fuel price at the start of January might explain the slight drop in the index relative to December. If so, the increase in the fuel price effective tomorrow may once again put upward pressure on costs.

For further information: Lisette IJssel de Schepper, Senior Economist, BER (Tel: 021 808 9777)

The PMI is an economic activity index based on a survey conducted by the Bureau for Economic Research (BER) and sponsored by Absa. Although reasonable professional skill, care and diligence are exercised to record and interpret all information correctly, Stellenbosch University, its division BER, the author(s)/editor and Absa (inclusive of its affiliates and/or subsidiaries) do not accept any liability for any direct or indirect loss whatsoever that might result from unintentional inaccurate data and interpretations provided by the BER, as well as any interpretations by third parties. Stellenbosch University and Absa further accept no liability for the consequences of any decisions or actions taken by any third party on the basis of information provided in this publication. The views, conclusions or opinions contained in this publication are those of the BER and do not necessarily reflect those of Stellenbosch University or Absa. Absa is an authorised financial services provider and registered credit provider reg no NCRCP7.