In many of our recent dealings with South African companies, there has been a common issue with abuse and fraud committed by employees on their company-issued credit cards. These cards are generally provided to employees on the understanding that they are to be used for business expenses only, and in most cases this is reinforced by either the company’s policies or a specific “cardholder use” agreement signed by the employee. How is it then that this fraud and abuse is so widespread?

“I think one of the answers lies in the tendency of companies to not bring the full weight of their policies to bear through disciplinary action, especially in fear of losing otherwise productive employees”, Julian Curtiss, Managing Director of Transaction Technology Solutions tells SmartProcurement.

“This is contrasted by the view held by a German counterpart who told me, at a commercial card conference, that if employees were to commit fraud, or abuse their company credit cards, “we would fire them”. Perhaps that goes some way to explain why they do not have problems with fraud and abuse.

One of our clients was faced with this problem. The client had in excess of four hundred company credit cards, all of which were settled by the company. These cards were what are known as “Company Liability/Company Billed”, where the credit is “scored” against the company and the company settles all the card accounts directly with the bank. They were utilising MasterCard’s SmartData Online™, a web-based tool that was provided by the card association. This, however, had not been implemented properly by MasterCard’s appointed implementer and as a result the company was not enjoying all the benefits of the web-based tool. Used correctly, it should have been instrumental in detecting and preventing the fraud and abuse that was taking place. The proverbial horse had bolted and the CEO was under pressure to implement changes to eliminate this problem.

This is when Transaction Technology Solutions was engaged, to undertake a review of the Travel and Expenditure (T&E) framework at the client, and to make recommendations on the most effective remedial action. We utilised two primary analysis models; the “Transaction Technology Solutions T&E Framework Cube” and the “Aberdeen T&E Management Lifecycle”.

Figure 1: T&E Analysis Cube Figure

Figure 2: Aberdeen T&E Lifecycle

- what arrangements are in place for the management of T&E in the company; and

- how these arrangements benchmark to best practices.

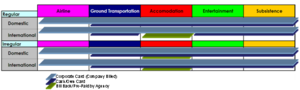

The over-riding findings were that the company was generally operating at a best practice level in most categories. The payment mechanisms used for the various categories of spend were as per Figure 3.

Figure 3: Methods of Payment in use

The main problems were:

- the poorly implemented and supported web-based management tool;

- inadequate and inconsistent application of the company’s policies, which did in fact allow censure for incorrect use;

- the company allowed the use of the company credit card for Subsistence, as well as paying a Per Diem out of town allowance in cash;

- the company also allowed the use of the cards for personal expenses when overseas, which was making the application of the policies difficult to enforce; and

- reclaiming personal expenses from the employees was creating additional work for the finance department, especially from employees in financial difficulty.

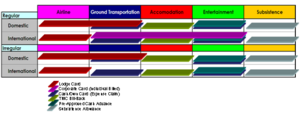

The initial recommendation was to amend the policies to enable the following payment mechanisms.

Figure 4: Proposed Methods of Payment

This framework recommended, among other things:

- That all airline transactions would be processed via Lodge Cards (see http://www.ttsolutions.co.za/corporatepaymentsolutions.html for details on the different types of company credit card solutions). This would enable the company to reduce the credit limits on all of the cards, thus reducing the potential impact of fraud and abuse.

- Company credit cards would only be issued to regular international travellers or ‘special cases’, dramatically reducing the number of cards issued.

- These cards would also be ‘Company Liability/Individual Billed’ which means, whilst it is the Company’s ‘credit’, settlement is drawn from the individual’s bank account.

- The travellers would receive a daily travel allowance for all personal and subsistence needs, and the cards would only be used for direct business expenses.

This should have addressed all of the problems; however the following issue

s still persisted:

- Cardholders still had the capacity to commit fraud and abuse.

- The company still had the administration problems of recovering fraud, abuse and personal expenses posted to the cards.

- There were intense ‘political’ debates over who qualified for the cards.

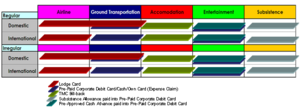

Ultimately, the CEO approved the following framework:

Figure 5: Approved Methods of Payment

In this framework:

- there would be no company credit cards at all, save for a few at Executive level;

- the rigour around processing would be transferred to the ‘pre-approval’ stage, where everything, including entertainment, would have to be pre-approved. This would be done via the T&E management modules in the company’s existing ERP system. (The CEO made the point that much rigour was applied to ensure the traveller hired the correct vehicle, costing a few hundred Rand, yet the same traveller was able, at their own discretion, to spend thousands of Rand on entertainment.)

- employees would be paid cash advances based on approved Trip/Entertainment Requests, where appropriate, into a prepaid corporate debit card solution.

- all expense claims are to be processed via the same ERP system, drawn down from what was pre-approved.

The direct cash benefits achieved by the company are:

- An immediate 45% reduction in entertainment costs, as the discretion of the employee has been eliminated from the decision making.

- A saving of R48 000 in annual card fees.

- A saving of R42 000 in annual fees for use of the card association’s web-based management tool.

- An annual saving in external facilitator costs for disciplinary hearings associated with fraud and abuse of the cards.

Indirect benefits include:

- A reduction in business processing costs associated with:

a. possessing card statements;

b. managing delinquent cardholders; and

c. managing the difficult bank relationship in respect of:

i. replacing lost and stolen cards,

ii. managing non-employee fraud,

iii. managing card renewals,

iv. erratic card deliveries, and

v. recovering cards from departing employees.

- No more hassles with MasterCard’s SmartData Online™ solution or their approved service and support partner, as everything was now processed via the ERP system.

Through this project, the CEO and the Group Travel team have delivered more control and compliance to the organisation, along with significant cost savings. This has been achieved without the use of company credit cards or additional business systems; although the company has recognised that it may need to invest in specific T&E management systemsin the future. This would have been required, even if they had stayed with the company credit cards. The CEO’s final word on the matter was that “prevention is better than cure, and, therefore, regardless of the claims of the control and compliance benefits of company credit cards, I would rather prevent fraud and abuse, than spend money and time trying to detect and manage it”.

About the Author

Julian Curtiss is Managing Director of Transaction Technology Solutions. He has consulted to some of South Africa’s largest corporations on the benefits of financial process re-engineering. Julian has been involved in financial projects for over 12 years, incorporating work in the UAE, United Kingdom, Zimbabwe, Kenya, Uganda and South Africa. These have included the implementation of Business Management Systems such as Sage Software, ERP systems such as JDEdwards (Softline), E-Procurement systems such as SAP Enterprise Buyer, and card management systems such as VISA’s Information Source ™ and MasterCard’s SmartData Online ™. Julian is a regular speaker at industry conferences and a regular contributor to many industry journals.

Julian Curtiss can be contacted at the details below:

Telephone: +27 11 269 4307

email: www.ttsolutions.co.za